Trusted identity insights. Refreshed daily.

idiCORE's real-time identity intelligence helps the financial services industry combat fraud.

Unravel complex cases. Prevent fraud faster.

.png?width=1200&height=627&name=Fraud%20testimonial%20-%20idiCORE%20(4).png)

The rise of synthetic identities and sophisticated fraud rings continues to fuel loan, credit card, and bank account fraud. idiCORE is built for investigators, delivering real-time, actionable intelligence that reveals hidden connections between individuals and businesses. With advanced analytics and seamless accessibility, idiCORE empowers fraud investigators to dig deeper than credit header files and leverage valuable identity risk flags to make informed decisions.

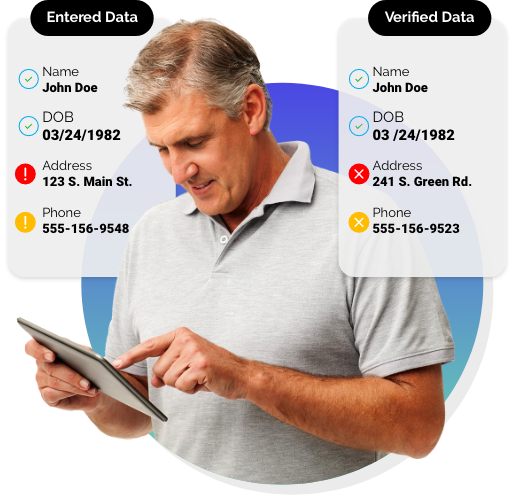

Enhanced Due Diligence for Loan and Credit Applications

When new customers or existing customers apply for loans, verify applicants' identities with idiCORE's comprehensive repository of credit header, proprietary, public record, and publicly available data covering nearly 100% of the U.S. adult population. Compare loan applications to idiCORE's identity and business data, which is updated daily.

Investigative Insights for KYC and KYB

Whether you’re investigating customer disputes or fraudulent loan applications, identity and business intelligence at your fingertips can improve case outcomes. Verify business Tax IDs, entity names, and other critical information that may indicate potential fraud is taking place or the need for advanced review.

High-Risk Flags

Fraudsters strategically mix and match PII and combine popular first and last names to blend in. idiCORE's risk flags indicate frequently used SSNs, addresses, and phone numbers that represent elevated risk. Additionally, our risk flags can detect high turnover phone numbers, short duration addresses, the use of deceased identities, fraud-related criminal history, and more.

SSN Risk

Phone Risk

Address Risk

Identity Risk

Frequently asked questions

Does idiCORE integrate with my existing systems?

Yes, idiCORE seamlessly integrates into your existing workflows—whether online, batch, or API. Maximize the value of your data with the speed, power, extensibility, and scalability of idiCORE.

How does the idiCORE trial work?

Our trial period for law firm customers is 14 days. To start your trial, follow these simple steps:

-

Request a trial

-

Meet with an IDI team member who will show you the platform

-

Complete the Subscriber Agreement

-

Get credentialed

-

Test idiCORE and provide feedback

Where does idiCORE's identity intelligence data come from?

idiCORE structures and unifies billions of disparate data points, which are sourced from proprietary, public record, and publicly-available data.

Who uses idiCORE's data?

Thousands of customers use idiCORE across industries including law enforcement, legal, insurance, retail, and more.

Combat fraud with idiCORE

.png?width=1440&height=810&name=Computer%20with%20idiCORE%20UI%20(1).png)